Bitcoin (CRYPTO: BTC) should be viewed as an asset uncorrelated to U.S. tech assets over the long term, according to Jay Jacobs, U.S. Head of Equity ETFs at BlackRock (NYSE:BLK). What Happened: Speaking in an interview with CNBC on Thursday, Jacobs ...

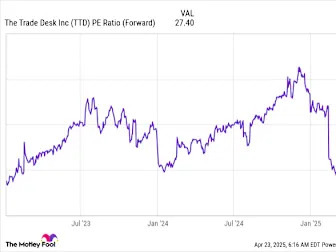

The stock market drawdown has opened up several investment opportunities, but few are more attractive than The Trade Desk (NASDAQ: TTD) right now. The Trade Desk's growth runway is massive, and if you don't buy shares of this top-tier company, you'll regret it years down the road. The Trade Desk has been a rock-solid performer for its entire life on the public markets.

Investors didn't rush to buy Lockheed Martin stock this week. They might want to reconsider.

Key Insights Given the large stake in the stock by institutions, McDonald's' stock price might be vulnerable to their...

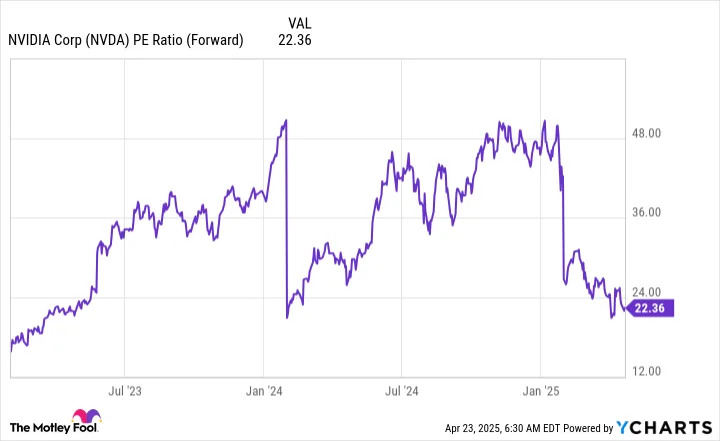

Nvidia (NASDAQ: NVDA) has been notorious for being a high-growth, highly valued stock since its run began in early 2023. Now, it's nearly the same price as the S&P 500 (SNPINDEX: ^GSPC), which is an odd thing to say considering how much growth Nvidia is expected to put up over the next few years. By definition, forward earnings haven't been achieved yet; they're just projections.

This commission-free brokerage still looks like a flimsy investment.

After a strong run for the stock market the past two years, volatility has returned in 2025. While the S&P 500 (SNPINDEX: ^GSPC) is down 8% at the time of writing, some companies that entered the year with strong momentum are holding up quite well. Shares of Palantir Technologies (NASDAQ: PLTR) and Uber Technologies (NYSE: UBER) are two of the best performing stocks in the S&P 500 this year.

Key moments from the last seven days, plus a glimpse at the week ahead

The S&P 500 index (SNPINDEX: ^GSPC) is made up of 500 companies from 11 different sectors of the economy, so it's the most diversified of the major U.S. stock market indexes. It's currently down 12.5% from its record high, placing it firmly in correction territory, amid simmering global trade tensions that were sparked by President Trump's "Liberation Day" on April 2. The president announced a sweeping 10% tariff on all imported goods from America's trading partners, in addition to much higher "reciprocal tariffs" on goods from specific countries that have large trade surpluses with the U.S. The reciprocal tariffs have been paused for 90 days (except those on Chinese goods) pending negotiations, but investors are still concerned about a potential economic slowdown, hence the stock market sell-off.

Which of these unloved AI stocks can make a comeback?