Key Takeaways

Shares of Semtech ( SMTC ) surged 15% Friday, a day after the semiconductor maker had better-than-anticipated profit and net sales, and operating cash flow more than doubled.

Semtech swung to a fourth-quarter fiscal 2025 adjusted profit of $0.40 per share from an adjusted loss of $0.06 per share a year earlier. Analysts surveyed by Visible Alpha were looking for adjusted earnings per share (EPS) of $0.31. Net sales rose 30% year-over-year to $251 million, also above forecasts.

Cash flow from operating activities was $33.5 million, 141% higher than the prior year. For fiscal 2025, it was $58.0 million, compared to a decline of $93.9 million in 2024. CFO Mark Lin said the jump indicated a "positive inflection in our business and is expected to further benefit from lower cash interest requirements stemming from our debt reduction."

CEO Hong Hou noted that Semtech had "sequential improvement for each quarter reported in net sales, gross margin , operating margin and earnings per share."

The company sees current-quarter adjusted EPS with a midpoint of $0.37 and net sales of $250 million, above expectations.

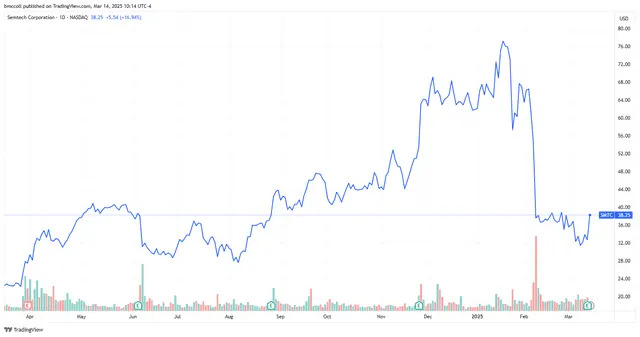

Semtech shares have added about two-thirds of their value over the last 12 months.

Read the original article on Investopedia