Dollar General Corporation DG reported fourth-quarter fiscal 2024 results, wherein both top and bottom lines beat the Zacks Consensus Estimate. While net sales increased, earnings decreased from the year-ago period.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Despite operating in a challenging environment where the core customer faces financial constraints, the company delivered same-store sales near the upper range of its expectations for the quarter. The ongoing success of the Back-to-Basics initiatives likely played a key role in this performance by improving operational execution and enhancing the in-store customer experience.

Moreover, the strategic focus on new store growth, coupled with an increased number of projects targeting improvements to its mature store base, is expected to further solidify Dollar General’s role as a vital partner in rural communities. These efforts are designed to provide a strong foundation for sustainable long-term growth and the creation of shareholder value.

More on DG’s Q4 Results

Quarterly adjusted earnings of $1.68 per share beat the Zacks Consensus Estimate of $1.50. However, the bottom line declined 8.2% from $1.83 in the prior-year period. On a GAAP basis, earnings declined 52.5% year over year to 87 cents per share in the quarter. The results include an estimated negative impact of 81 cents per share in the fiscal fourth quarter due to store closures and pOpshelf impairment charges.

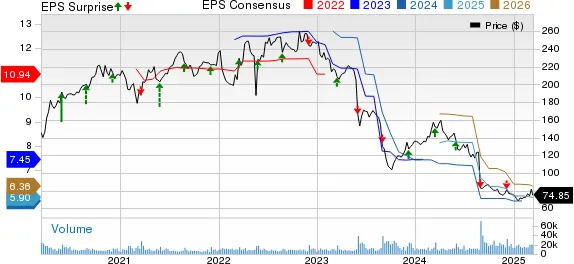

Dollar General Corporation Price, Consensus and EPS Surprise

Dollar General Corporation price-consensus-eps-surprise-chart | Dollar General Corporation Quote

Net sales of $10,304.5 million increased 4.5% year over year and surpassed the Zacks Consensus Estimate of $10,259 million. This increase was primarily driven by contributions from store openings and growth in same-store sales, though partially offset by the impact of store closures.

Same-store sales grew 1.2% year over year, with a 2.3% rise in average transaction amount and a 1.1% decrease in customer traffic. The growth in same-store sales was led by the consumables category, while the home, seasonal and apparel categories experienced declines. We anticipated same-store sales growth of 1% in the fiscal fourth quarter.

DG’s Quarterly Performance: Key Metrics & Margin Insights

For the quarter, net sales by category showed varied performance. The consumables category saw a significant increase of 5.3%, reaching $8.32 billion. Net sales for the seasonal category totaled $1.11 billion, an increase of 1% compared with the same period last year. Home products sales grew 2% to $593 million and apparel saw an increase of 1.6%, reaching $279.5 million.

The gross margin shrunk 8 basis points to 29.4%. This contraction in the gross margin was due to higher markdowns, increased inventory damages, distribution costs and a larger share of sales from the consumables category. These factors were partially offset by higher inventory markups and lower shrinkage.

Selling, general and administrative expenses, as a percentage of net sales, increased 294 basis points to 26.5% in the quarter. The increase was primarily caused by $214 million in impairment charges related to the store portfolio optimization review. Additionally, higher retail labor, incentive compensation, repairs and maintenance, depreciation and amortization, and technology-related expenses contributed to the increase. These were partially offset by a decline in professional fees. We had anticipated 80 basis points deleverage in SG&A expenses.

We note that the operating profit declined 49.2% year over year to $294.2 million, primarily reflecting $232 million in charges related to the store portfolio optimization review. The operating margin contracted 300 basis points to 2.9%. We envisioned a 100-basis point decrease in the operating margin.

Dollar General’s Store Expansion & Remodeling Plans

During fiscal 2024, Dollar General opened 725 new stores, remodeled 1,621 locations and relocated 85 stores. In fiscal 2025, the company plans to execute 4,885 real estate projects, including the opening of 575 new stores in the United States and up to 15 new stores in Mexico. Additionally, the company aims to fully remodel 2,000 stores, remodel 2,250 stores through Project Elevate and relocate 45 stores.

DG’s Financial Snapshot

This Goodlettsville, TN-based company ended the quarter with cash and cash equivalents of $932.6 million, long-term obligations of $5.72 billion and total shareholders’ equity of $7.41 billion. Management incurred capital expenditures of $1.3 billion during fiscal 2024. For fiscal 2025, the company anticipates capital expenditures in the band of $1.3-$1.4 billion.

During fiscal 2024, Dollar General did not repurchase shares. The company did not intend to repurchase shares in fiscal 2025.

What to Expect From Dollar General in FY25?

Dollar General envisions net sales growth between 3.4% and 4.4%. It foresees same-store sales growth to fall between 1.2% and 2.2%. Management anticipates earnings of $5.10-$5.80 per share.

Shares of this Zacks Rank #3 (Hold) company have lost 0.6% in the past three months compared with the industry’s decline of 8.5%.

Do not Miss These Solid Bets

Sprouts Farmers

SFM, which is engaged in the retailing of fresh, natural and organic food products, currently has a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

The Zacks Consensus Estimate for Sprouts Farmers’ current financial-year sales and earnings implies growth of 12% and 22.9%, respectively, from the year-ago reported numbers. SFM delivered a trailing four-quarter earnings surprise of 15.1%, on average.

Farmer Bros. Co.

FARM engages in the roasting, wholesale, equipment servicing and distribution of coffee, tea and other allied products in the United States. It currently carries a Zacks Rank #2. FARM delivered a trailing four-quarter earnings surprise of 35%, on average.

The Zacks Consensus Estimate for Farmer Bros.’ current financial-year sales and earnings implies growth of 3.3% and 25%, respectively, from the year-ago period’s reported figure.

Post Holdings, Inc.

POST operates as a consumer-packaged goods holding company in the United States and internationally. It currently has a Zacks Rank #2. POST delivered a trailing four-quarter earnings surprise of 22.3%, on average.

The Zacks Consensus Estimate for Post Holdings’ current fiscal-year sales and earnings indicates growth of 0.3% and 2.2%, respectively, from the prior-year reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar General Corporation (DG) : Free Stock Analysis Report

Farmer Brothers Company (FARM) : Free Stock Analysis Report

Sprouts Farmers Market, Inc. (SFM) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research