Key Takeaways

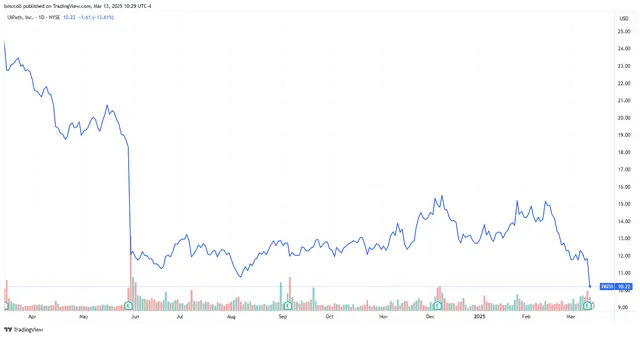

Shares of UiPath ( PATH ) plunged to an all-time low Thursday after the maker of automated software gave weaker-than-expected guidance as it warned Trump administration spending cuts and changing economic conditions will hurt results.

The company sees current-quarter revenue of $330 million to $335 million, and fiscal 2026 revenue of $1.525 billion to $1.530 billion. Analysts surveyed by Visible Alpha were looking for $369.6 million and $1.59 billion, respectively.

Chief Operating and Financial Officer Ashim Gupta explained that UiPath was monitoring "many moving parts in the macroeconomic landscape, including the U.S. public sector and global economic conditions." Gupta added that "while we remain optimistic about the long-term opportunity in the U.S. public sector, the ongoing transition has created short-term uncertainty for deal closures," and that factored into the outlook.

Q4 Profit Tops Analysts' Estimates, But Revenue Comes Up Short

For the fourth quarter, UiPath reported adjusted earnings per share (EPS) of $0.26 that exceeded Visible Alpha forecasts. Revenue that rose 4.5% year-over-year to $423.6 million came up just short of expectations.

Separately, UiPath announced it had purchased U.K.-based Peak, which offers an artificial intelligence (AI) -based platform to help optimize product inventory and pricing for businesses. Terms of the deal were not disclosed.

UiPath shares sank 14% to $10.15 in late-morning trading after earlier touching an all-time low $9.50. They have lost nearly 60% of their value over the past year.

Read the original article on Investopedia