Viking Therapeutics VKTX signed a broad multi-year manufacturing agreement with CordenPharma, a contract development and manufacturing organization (CDMO), for both the oral and subcutaneous (SC) formulations of its obesity drug VK2735.

Per the terms, Viking has secured dedicated manufacturing capacity to support the large-scale production of VK2735. The deal includes an annual supply commitment for multiple metric tons of the active pharmaceutical ingredient (API) behind VK2735, along with fill/finish capacity for both versions of the drug.

CordenPharma will provide 100 million autoinjectors, 100 million vial and syringe products, and over 1 billion oral VK2735 tablets annually through dedicated manufacturing lines. In addition, VKTX will retain an option to expand these capacities.

In consideration of these rights, Viking Therapeutics will make prepayments totaling $150 million over the next three years. These payments will be credited against future orders.

VKTX’s Progress With Its Obesity Program Encouraging

VK2735 has shown blockbuster potential, demonstrating superior weight reduction capabilities across both oral and SC formulations. In November, Viking presented updated results from the phase I study on oral VK2735 at the annual meeting of ObesityWeek. The results showed that patients who received the highest drug dose lost up to 8.2% in body weight after 28 days of daily dosing compared with 1.4% in the placebo group. Last year, management reported that the phase II VENTURE study, which evaluated VK2735 SC, achieved its primary and all secondary endpoints with statistical significance.

Based on the above results, management started the phase II VENTURE-Oral Dosing study to evaluate the safety and efficacy of the oral version of VK2735 over a 13-week treatment period. VKTX also announced plans to start a late-stage study on the SC version in second-quarter 2025.

VKTX’s Share Price Performance

Despite the positive announcement, shares of Viking 5% yesterday. Though this deal reduces the supply-chain risk on VKTX stock, which is currently devoid of a marketed product, some investors were of the view that the deal indicated that Viking was not open to takeover discussions. This was a likely reason behind the company’s share price decline.

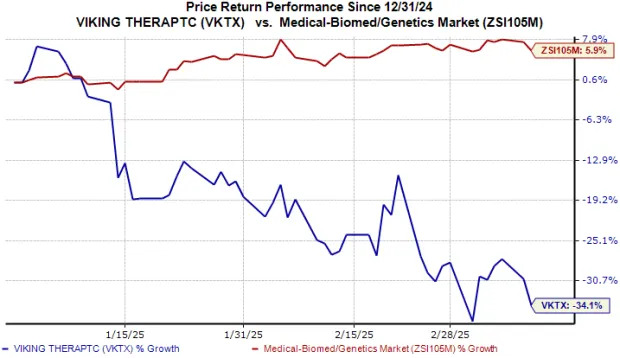

Year to date, Viking’s shares have lost 34% against the industry’s 6% growth.

Stiff Competition in the Obesity Space

The obesity market has garnered much interest lately, with two companies, Eli Lilly LLY and Novo Nordisk NVO, dominating this space with their respective obesity drugs Zepbound and Wegovy. Per a research conducted by Goldman Sachs, the obesity market in the United States is expected to reach $100 billion by 2030. This is also evident from the fact that all large drugmakers are looking to strengthen their presence in this market by expanding their existing obesity pipeline or acquiring smaller biotechs with novel obesity candidates in their pipeline.

Lilly is investing broadly in obesity and has several new molecules currently in clinical development. These include two late-stage candidates — orforglipron, an oral GLP-1 small molecule and retatrutide, a GGG tri-agonist — and some mid-stage candidates, namely bimagrumab, eloralintide and mazdutide.

Like Lilly, Novo Nordisk is developing multiple other candidates, including the unimolecular GLP-1, amylin receptor agonist amycretin and next-gen subcutaneous obesity treatment candidate, CagriSema. NVO is also evaluating several other obesity drugs across separate early to mid-stage studies.

Some recent entrants in the obesity space include Merck MRK and AbbVie ABBV. Both MRK and ABBV entered this space through a similar route — a licensing deal. While AbbVie forayed into the obesity space after signing a licensing agreement with Denmark-based biotech Gubra for the latter’s experimental obesity drug, Merck secured a licensing deal for an investigational oral weight-loss drug developed by China-based Hansoh Pharma in December.

Viking Therapeutics, Inc. Price

Viking Therapeutics, Inc. price | Viking Therapeutics, Inc. Quote

VKTX’s Zacks Rank

Viking Therapeutics currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Viking Therapeutics, Inc. (VKTX) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research