SentinelOne

S is set to report fourth-quarter fiscal 2025 results on March 12.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar

.

The company expects revenues of $222 million for the fiscal fourth quarter. The Zacks Consensus Estimate for revenues is pegged at $222.03 million, suggesting growth of 27.47% from the year-ago quarter’s reported figure.

The consensus mark for earnings has been unchanged at 1 cent per share over the past 30 days. S reported a loss of 2 cents in the year-ago quarter.

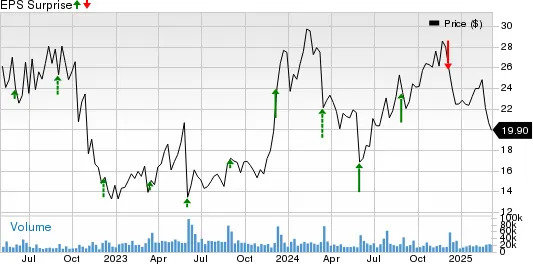

SentinelOne’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, missing once, the average earnings surprise being 62.50%.

SentinelOne, Inc. Price and EPS Surprise

SentinelOne, Inc. price-eps-surprise | SentinelOne, Inc. Quote

Let us see how things have shaped up for S shares prior to this announcement.

Factors to Note Before SentinelOne’s Q4 Earnings

SentinelOne has been suffering from challenging macroeconomic conditions and stiff competition in the cybersecurity space. Despite these headwinds, SentinelOne’s fiscal fourth-quarter performance is likely to have benefited from the strong adoption of the Singularity platform.

The Singularity platform is enhanced by Purple AI, S’s advanced Generative AI (GenAI) security analyst. Purple AI significantly accelerates threat hunting and investigations, reduces Mean Time to Response and provides comprehensive end-to-end enterprise security. Purple AI suite has evolved to be the company’s fastest-growing solution. This is expected to have driven the adoption of SentinelOne’s solutions.

Strong momentum with large enterprise customers is expected to have continued in the fourth quarter of fiscal 2025. Customers with more than $100,000 in ARR grew 24% year over year to 1,310 in the fiscal third quarter. ARR per customer increased year over year in the double-digits, driven by strong platform adoption and success with larger enterprises.

The Zacks Consensus Estimate for fourth-quarter fiscal 2025 ARR is pegged at $921 million, suggesting 27.2% year-over-year growth. The consensus mark for Customers with more than $100,000 in ARR is pegged at 1,370, indicating 21% year-over-year growth.

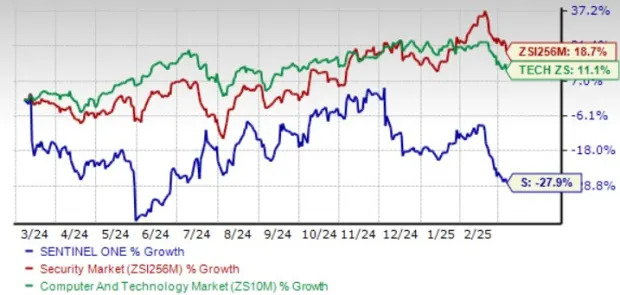

S Shares Lag Sector in a Year

In the trailing 12 months, SentinelOne shares have declined 27.9%, underperforming the broader Zacks Computer and Technology sector’s return of 11.1% and the Zacks Security industry’s appreciation of 18.7%.

SentinelOne’s One-Year Performance

The S stock is not so cheap, as the Value Score of F suggests a stretched valuation at this moment.

In terms of the forward 12-month price/sales ratio, SentinelOne shares are trading at 6.1X, higher than the sector’s 6.06X.

P/S Ratio (F12M)

Strong Portfolio, Partner Base Aids S’s Prospects

SentinelOne’s long-term growth trajectory remains intact, driven by an innovative portfolio. Its Singularity platform unifies data capabilities and AI-powered security across endpoint cloud identity, as well as third-party integrations, all in one single user interface.

Solutions, including Singularity Endpoint, Singularity Cloud Security, Singularity Data and Purple AI, are helping SentinelOne address a total market worth more than $100 billion. The total Addressable Market for Endpoint Security, Data Analytics, Cloud Security and Generative AI Security is pegged at $17 billion, $31 billion, $12 billion and $3 billion, respectively, which offers significant growth opportunities for SentinelOne.

S’s strong partner base, which includes

Alphabet

GOOGL, Lenovo,

Amazon

AMZN and

ServiceNow

NOW, is helping it win customers.

Singularity Cloud Workload Security for Serverless Containers provides real-time, AI-powered protection for containerized workloads running on Amazon Web Service (“AWS”) Fargate for Amazon ECS and Amazon EKS. The company also deepened its integration with AWS. Purple AI is becoming available through Amazon Bedrock, which expanded SentinelOne's capabilities to assist organizations in securing GenAI applications.

In the third quarter of fiscal 2025, SentinelOne partnered with Lenovo to pre-install the Singularity platform and Purple AI on enterprise PC shipments, drastically increasing its market reach. The SentinelOne App seamlessly syncs threats into ServiceNow Incident Response for security operations and incident response.

SentinelOne Ahead of Q1 Results: Buy or Sell?

SentinelOne’s strong portfolio, which leverages AI and a strong partner base, is a positive.

However, challenging macroeconomic conditions and a stretched valuation make the stock a risky bet. S shares are trading below the 50-day and 200-day moving averages, indicating a bearish trend.

S Shares Trade Below 50-Day & 200-Day SMA

SentinelOne currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a favorable time to start accumulating the stock.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

SentinelOne, Inc. (S) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research